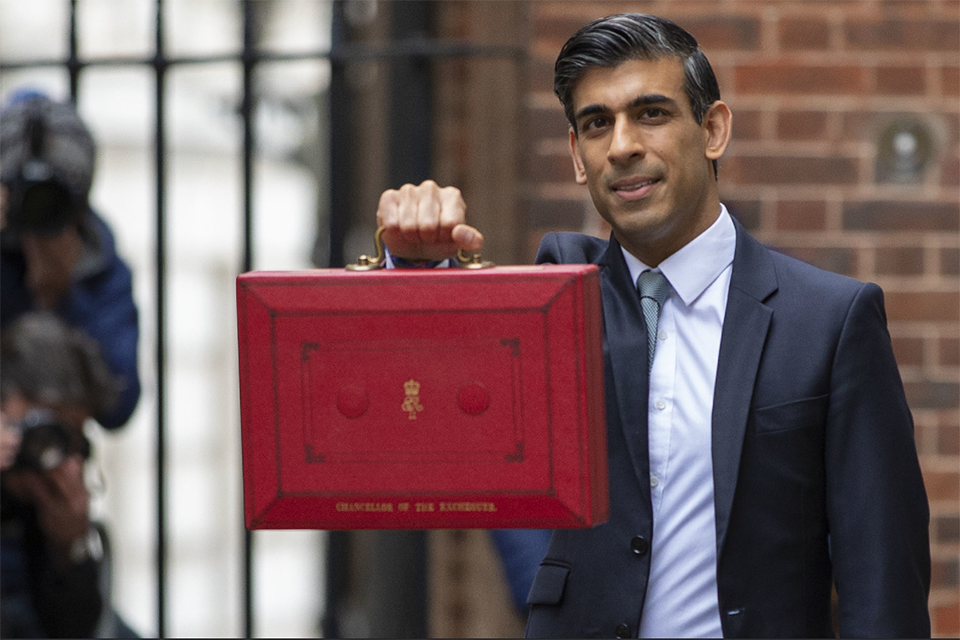

A Budget intended to help drive economic growth as we recover from Coronavirus also brought some welcome changes for the pensions world, says a Quantum Advisory expert.

Pension tax top-ups for low earners

The Government will develop a solution to the ‘net pay anomaly’ where some low earners can miss out on tax relief if they pay pension contributions through a ‘Net Pay’ arrangement. From 2025/26 a system will be put in place that provides top-ups to affected individuals to broadly give the same outcome as if they paid contributions through a ‘Relief at Source’ arrangement.

The system will apply to pension contributions made from 2024/25 onwards. The Government calculates the average benefit for affected individuals to be £53 per year.

Simon Hubbard, a Senior Consultant and Actuary at Quantum Advisory, said: “Industry commentators have been asking the Government for years now to resolve the unfair tax treatment of pension contributions by low-paid workers. This change will be welcomed by many, though it’s disappointing that it will not apply until April 2024. However, the bigger question of increasing the auto enrolment minimum contribution amounts has been avoided for a further year.”

Changes to the charge cap on defined contribution (DC) pensions

The Government will consult on how the 0.75% pa cap on DC pension scheme charges can be adapted to allow for well-designed investment performance fees. The cap currently prevents the default investment strategy from using funds with a performance-related fee because it could exceed the cap if performance is strong.